In the digital age, Unified Payments Interface (UPI) has revolutionized the way we conduct financial transactions. It offers unparalleled convenience, allowing users to transfer money, pay bills, and make purchases with just a few taps on their smartphones. However, like any technology, UPI payments can sometimes encounter issues, leaving users frustrated and confused. If you’ve ever faced the predicament of a stuck or failed UPI payment, you’re not alone. In this comprehensive guide, we’ll explore common reasons behind UPI payment failures and provide you with proven tips to ensure your transactions go smoothly.

Understanding UPI Payments

What is UPI?

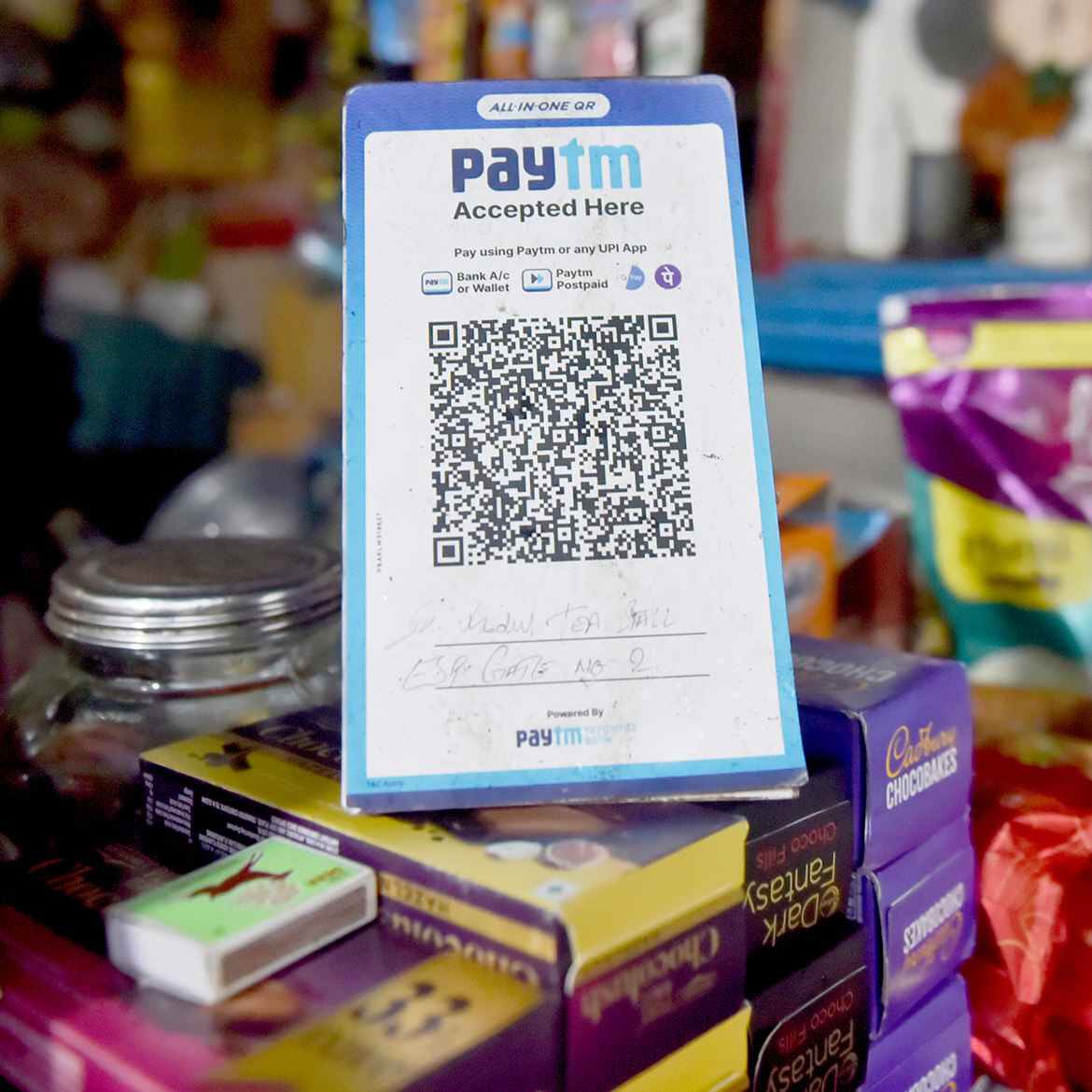

Unified Payments Interface, commonly known as UPI, is a real-time payment system developed by the National Payments Corporation of India (NPCI). It allows users to link multiple bank accounts to a single mobile application, facilitating seamless fund transfers.

The Popularity of UPI

UPI has gained immense popularity due to its user-friendly interface and security features. It has become the go-to choice for millions of Indians for various financial transactions.

Common Reasons for UPI Payment Failures

Insufficient Balance

One of the most common reasons for UPI payment failures is an insufficient balance in your linked bank account. Ensure that you have enough funds before initiating a transaction.

Incorrect UPI PIN

Entering the wrong UPI PIN can result in payment failures. Double-check your PIN before proceeding with a transaction.

Technical Glitches

Sometimes, technical issues on the bank’s or the UPI platform’s end can lead to payment failures. These are usually temporary and resolve on their own.

Proven Tips to Complete Your UPI Transactions (H2)

Verify Recipient Details

Before sending money, confirm the recipient’s UPI ID or mobile number. Any error in the recipient’s information can cause payment failures.

Use a Stable Internet Connection

A weak or unstable internet connection can lead to transaction failures. Ensure you have a strong network signal when making UPI payments.

Retry After Some Time

If your UPI payment fails, don’t panic. Wait for a while and then attempt the transaction again. Often, this resolves the issue.

Advanced Troubleshooting (H2)

Contact Customer Support

If your payment issues persist, reach out to your bank’s customer support or the UPI platform’s helpline. They can provide personalized assistance.

Check Transaction History

Review your transaction history to identify any failed payments. This can help you pinpoint the exact issue and seek a solution.

Conclusion

UPI payments have simplified our financial transactions, but occasional hiccups can occur. By following these tips and guidelines, you can ensure a smoother UPI payment experience. Remember to stay patient, verify details, and seek assistance when needed.

FAQs

Q1: What should I do if my UPI payment is stuck due to a technical glitch?

A. If your payment is stuck due to a technical glitch, wait for some time and try the transaction again. If the issue persists, contact your bank’s customer support.

Q2: Can I use UPI for international transactions?

A. No, UPI is primarily designed for domestic transactions within India. It cannot be used for international payments.

Q3: Are there any charges for using UPI?

A. Most banks offer UPI services for free, but it’s essential to check with your bank for any applicable charges.

Q4: How can I change my UPI PIN?

A. You can change your UPI PIN through your bank’s mobile app or by visiting your bank’s nearest branch.

Q5: Is UPI a safe payment method?

A. Yes, UPI is considered a secure payment method, thanks to its encryption and authentication features. However, it’s crucial to keep your UPI PIN confidential and use secure networks for transactions.